HARRISBURG, Pa. — With just a few weeks until the April primary elections in Pennsylvania, you’re probably noticing more campaign ads popping up on television screens.

That’s why we’re separating fact from fiction and breaking down some of the claims in those ads.

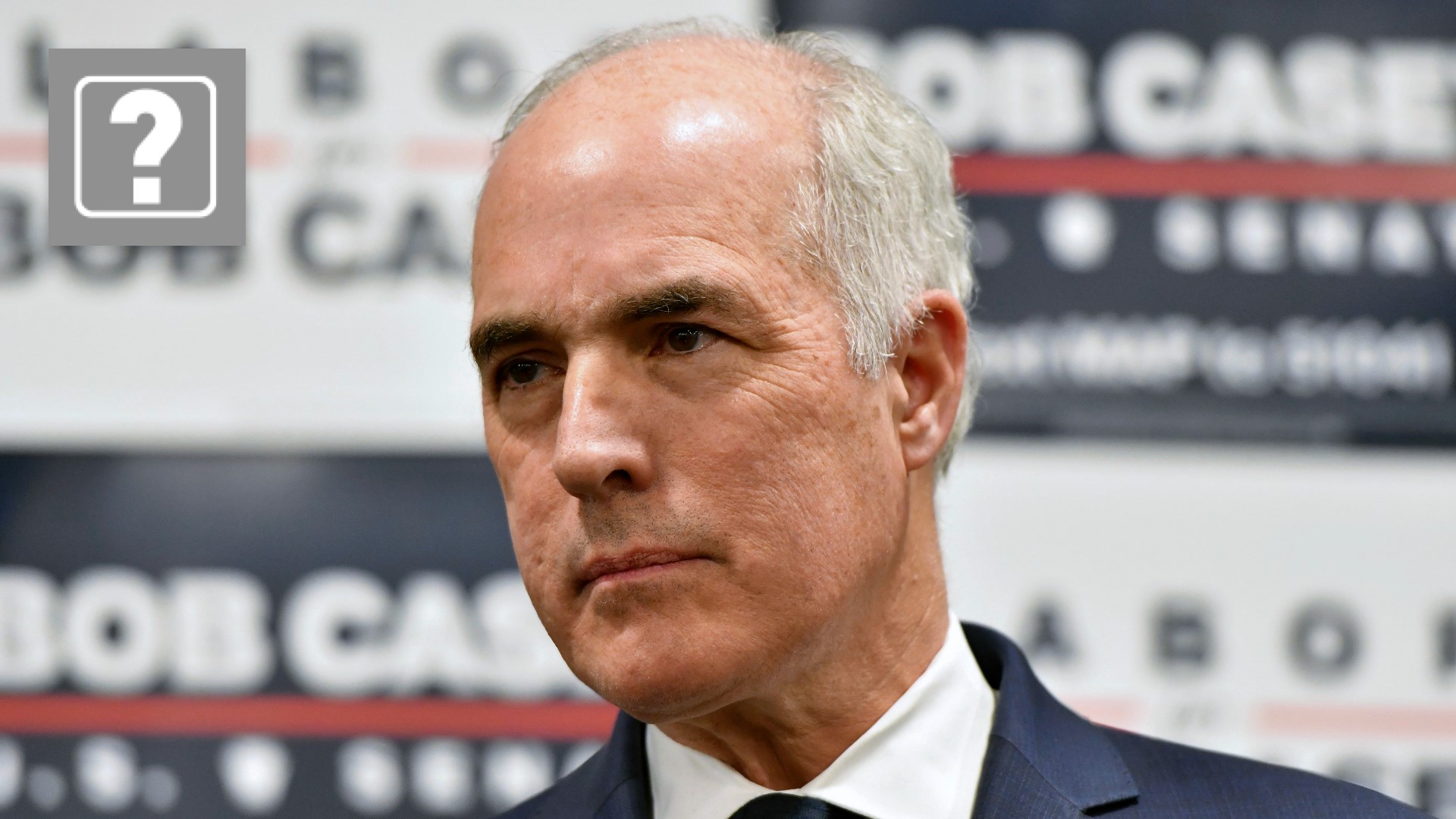

Democratic U.S. Senator Bob Casey is running for reelection in Pennsylvania and aimed at corporate leaders in his latest campaign ad.

"My plan gives the Federal Trade Commission the power to punish corporate price gouging," Casey said in his latest spot.

The ad claims corporations are pocketing increased profits from driving up prices.

"Chicken prices, 35% higher. The producer doubled their profits," a narrator reads.

So, let’s Verify.

Our sources are Federal Reserve Economic Data from the St. Louis Federal Reserve Bank, the U.S. Bureau of Labor Statistics and Tyson Foods.

This claim doesn’t provide a timeframe, but Senator Casey’s report entitled, “Greedflation” makes it more direct. It states Tyson Foods doubled profits from Quarter 1 of 2021 to Quarter 1 of 2022.

Tyson’s first quarter results from 2022 show a net income of $1.12 billion, up from $467 million in Q1 2021, more than double the previous year.

Data from the U.S. Department of Labor shows the price of a pound of boneless chicken breast rose from $3.35 in June 2021 to $4.56 in June 2022, a 36% increase.

So we can Verify this first claim is true.

This wasn’t the ad’s only statement on corporations.

"Corporations raising prices five times faster than inflation," a narrator said.

For this claim, we used two of our previous sources and data from the U.S. Bureau of Economic Analysis.

Again, the claim in the ad doesn’t give us a timeframe, but Casey’s “Greedflation” report said, “from July 2020 through July 2022, inflation rose by 14% but corporate profits rose 75% during the same period.”

U.S. Bureau of Labor Statistics data shows the consumer price index rose from 100 to 114 from July 2020 to July 2022, a 14% increase.

U.S. Bureau of Economic Analysis data shows before tax corporate profits rose from 100 in Quarter 2 of 2020 to 174.9 in Quarter 2 of 2022, or about a 75% increase.

But, that number does not adjust for inventory valuation or capital consumption.

U.S. Bureau of Economic Analysis data shows adjusted corporate profits went from $2.06 trillion in Quarter 2 of 2020 to $3.26 trillion in Quarter 2 of 2022.

That’s a 58% increase in profits or a little more than 4 times the rate of inflation.

So, we can Verify this claim needs more context.

Although the Casey campaign’s numbers are technically accurate, the report does not factor in adjustments that show how much companies are making from current production and account for depreciation.