HARRISBURG, Pa. — Benjamin Franklin once said, “In this world nothing can be said to be certain, except death and taxes.” In Pennsylvania, that also includes death taxes.

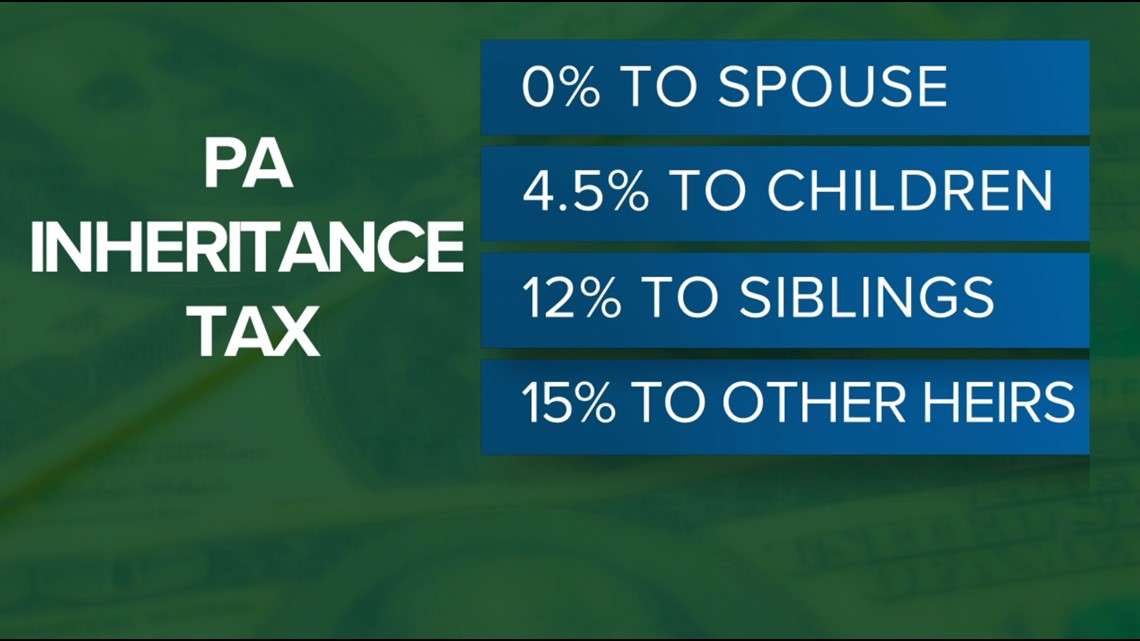

Pennsylvania is one of just six states to still have an inheritance tax, in which heirs of an inheritance must pay taxes to receive it. In Pennsylvania, there is no minimum threshold for the tax.

Twelve states have an estate tax, in which an estate is taxed when the owner dies. All of them exempt assets up to a certain amount, ranging from $1 million to $9.1 million. The federal government also has an estate tax that generally applies to assets more than $12.92 million in 2023.

Inheritance taxes have fallen out of favor in most states because they are widely seen as double taxation.

“This is money that was earned, usually subject to the individual income tax. It was taxed once and then spent on property. The original owner dies and now that property is transferred to a beneficiary and taxed again,” said Timothy Vermeer, Senior Policy Analyst at the Tax Foundation.

In Pennsylvania, the inheritance tax rate depends on the heir’s relation to the beneficiary. A spouse does not need to pay the tax, while the rate is 4.5 percent for children, 12 percent for siblings and 15 percent for all other heirs.

Applied to nearly all assets when a person dies, the taxes can add up.

“It creates this tax avoidance activity by families,” Vermeer said.

State legislators said efforts to avoid the tax are hurting Pennsylvania’s economy.

“We’re already seeing people leave Pennsylvania, particularly as they get older. They’ll go and buy apartments in Florida in order to avoid that tax while they’re still living here in Pennsylvania,” said State Rep. Valerie Gaydos (R-Allegheny).

Gaydos introduced a bill in 2021 to eliminate the state inheritance tax, but it never made it out of committee. She now plans to reintroduce the measure in the session beginning Jan. 3, 2023.

She argues the tax disproportionately affects working class people who can’t afford an out-of-state residence or the legal fees to set up trusts or other financial instruments to avoid the tax.

Losing the revenue from the tax may be a hard sell for some legislators, though. The inheritance tax brought in more than $1.5 billion last fiscal year, according to data from the state Department of Revenue.

“Yes, it is problematic that we have to take a look at what we replace it with or how we can be more efficient in government,” Gaydos said. “I think we can do a combination of both.”

Gaydos said she would also consider ideas to reduce the tax instead of eliminate it.

The late State Rep. Tony DeLuca (D-Allegheny) had introduced a bill last year to exempt the first $100,000 that a person inherits.