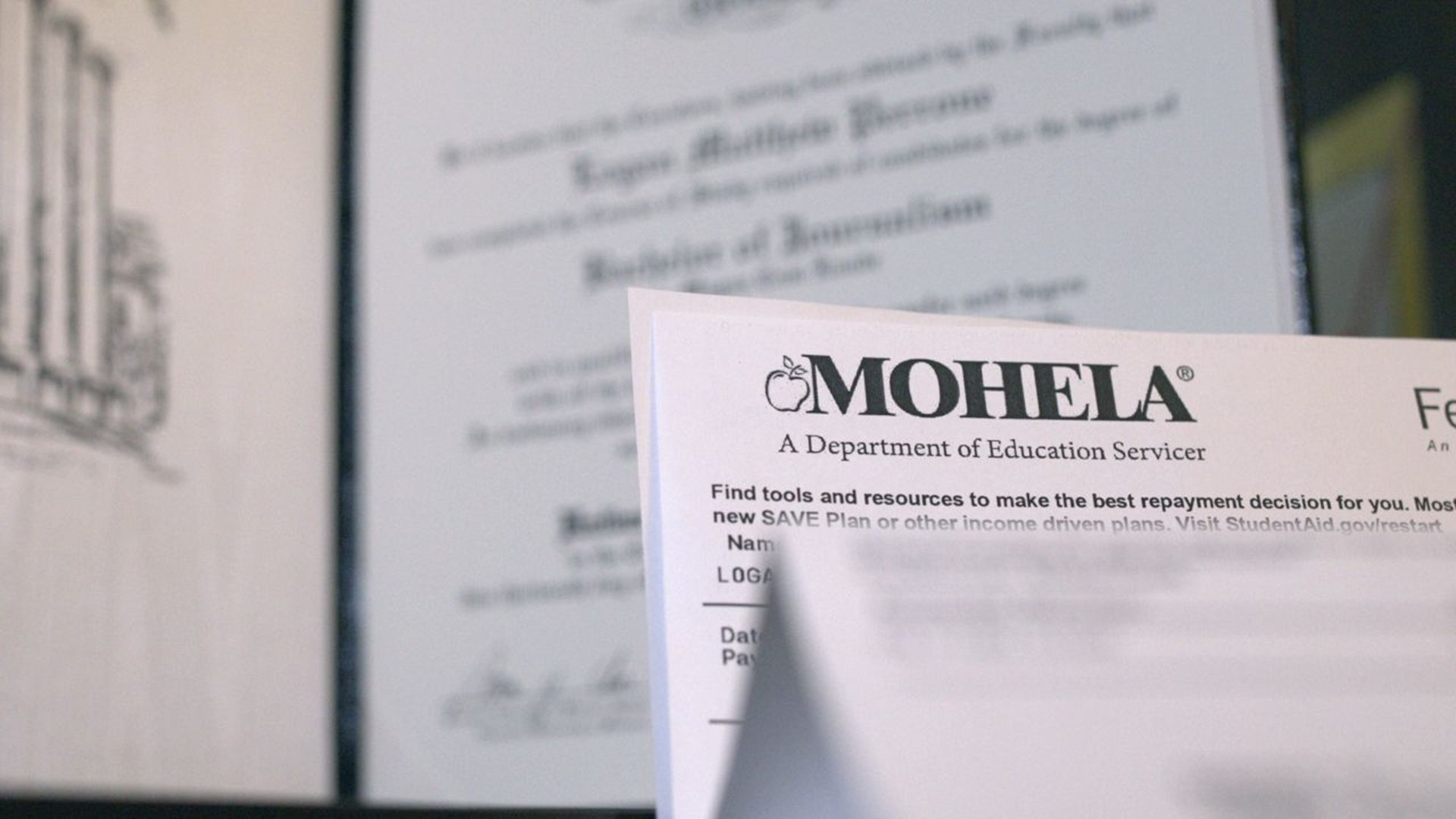

PENNSYLVANIA, USA — After a more than three-year pause, the bill is once again coming due for tens of millions of federal student loan borrowers.

“I think it came out to roughly just around 25,000," Wilkes University graduate Brandon Braye said.

Braye graduated with a mechanical engineering degree from Wilkes University in Northeastern Pennsylvania in 2019. Loan payments like his, which were paused in March 2020, will resume in October.

"It's going to be a new, interesting financial challenge that, you know, we're just going to be a part of life that you got to figure out," Braye said.

A survey from CNET found roughly 70% of borrowers will likely change spending habits to afford essential needs.

"I will have to do a couple of, you know, make a couple sacrifices here and there," Braye said. "Eat out less, start being more cognizant of how I choose to spend versus how I save."

Borrowers can also apply for Income-Driven Repayment plans like the Saving on a Valuable Education (SAVE) Plan, which can help borrowers who meet certain criteria lower or eliminate their payments. These include:

Saving on a Valuable Education (SAVE) Plan, formerly the REPAYE Plan

Pay As You Earn (PAYE) Repayment Plan

Income-Based Repayment (IBR) Plan

Income-Contingent Repayment (ICR) Plan

"If you qualify for this reduced payment or no payment, they’re going to freeze the balance right there," Bankrate CEO Ted Rossman said. "They’re not going to add interest to it."

Additionally, some occupations, such as teachers, government employees and select medical professionals are eligible for loan forgiveness. The Federal Student Aid website has the complete list of criteria that determines eligibility for one or more forms of debt management

It’s also important to be aware of scams.

Officials with the Better Business Bureau, The Federal Communications Commission and the Federal Trade Commission say borrowers should ignore any unsolicited phone calls, texts, or emails promising student loan forgiveness. The agencies also advise against giving out your social security number, birthday or bank details to any unverified companies.

Simple things like budgeting can help borrowers stay financially aware when adding the additional monthly expense.

"Quite literally, you could take a spreadsheet, a notebook [and] write down all the expenses," Braye said. "Unless you look at the hard numbers and understand how much you're spending, you're just going to keep mindlessly going at it over and over."

More than 40 million Americans have federal student loan debt, totaling more than one trillion dollars.