HARRISBURG, PA — Auditor General Eugene DePasquale said today his performance audit of the Public School Employees’ Retirement System (PSERS) found the need for legislative reform and operational improvements that include drastically reducing the amount of investment fees paid.

The 151-page audit report, which covers July 1, 2013 to March 31, 2017, includes 17 findings on six issues and makes 37 recommendations — 26 directed at PSERS, 10 directed at the General Assembly and one for the governor’s Office of Administration.

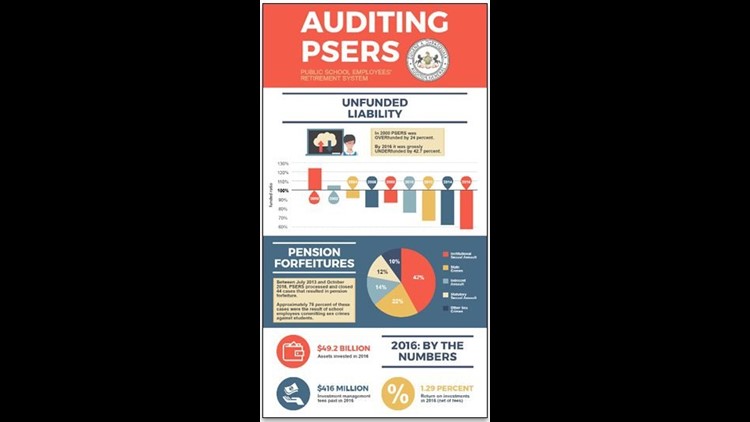

“One of my most significant concerns from this audit is that PSERS doesn’t seem to think spending more than $416 million on investment management fees in 2016 is a big deal,” DePasquale said. “It is mind-numbing that they want a pat on the back for reducing the fees from $441 million in 2015.

“There should be a never-ending focus on driving the fees paid by PSERS to the absolute lowest level possible,” he said, noting, “Every investment fee dollar saved remains in the pension fund for the benefit of the retirees and the accrued savings of the taxpayers.”

The audit also highlights the need for both the Public School Employees’ Retirement Code and the Public Employee Pension Forfeiture Act to be legislatively broadened. Additionally, auditors noted the need for PSERS to improve some of its internal operations in order to protect the long-term interests of the system’s members who consistently pay into the fund, school employers, and the taxpayers.

As with many public retirement systems, PSERS faces a large unfunded liability. In 2000 PSERS was overfunded by 24 percent and remained above 100 percent funded until 2003. As of June 30, 2016, PSERS was down to 57.3 percent funded with an unfunded liability of $43 billion; and assets of $49.2 billion invested.

“Pension reform has been discussed in Harrisburg for decades,” DePasquale said. “PSERS and the State Employees’ Retirement System, which I am also auditing, are the state’s two largest public pension plans and, collectively manage $78 billion worth of assets. My recommendations in this audit, and on SERS this summer, should help improve the operations of both systems and reduce the reliance on taxpayers.”

Reduce $416 Million+ in Management Fees

“While my audit confirmed that the investment management fees PSERS pays may be consistent with industry standards, the fees are woefully unfair to taxpayers and PSERS members,” DePasquale said. “PSERS pays nearly half-a-billion dollars to Wall Street and they are only following ‘industry standards.’

“I recognize the need for an appropriate mix of active and passive investments, but PSERS should use its leverage as one of the largest funds to aggressively reduce fees and change the industry standard to favor retirees, not Wall Street.

“If we continue to simply accept the so-called ‘industry standard,’ the approach to management fees will never change,” he said. “That’s a problem.”

Auditors were unable to determine the extent to which PSERS negotiated its fees because PSERS did not document its fee negotiations. DePasquale recommends PSERS take an aggressive position when negotiating fee structures with investment managers to obtain the lowest possible fees and document all fee structure discussions and negotiations between PSERS and the investment manager.

He noted that documenting the negotiation process provides assurance to stakeholders that management made a prudent effort to obtain the most advantageous fee structure for each manager.

“Reducing fees from $441 million to $416 million is a step in the right direction, but it’s a baby step at best,” DePasquale said, noting while PSERS reports more of the fees paid than many pension plans, it does not report fund-level expenses or portfolio company fees as investment expenses in its annual financial statements.

“Pennsylvanians deserve a full accounting of all expenses associated with managing public pension funds. I will settle for nothing less,” he said.

The audit includes a recommendation to hire high-quality in-house investment managers that could save tens of millions of dollars in management fees currently going to Wall Street.

“All of this leads to one question: How much of that more than $416 million could have remained in the retirement fund instead of being paid to Wall Street?”

Strengthen Pension Forfeiture Process

“When my team was checking if PSERS appropriately follows the Public Employee Pension Forfeiture Act — which they do — it quickly became clear there are problems with the language of the act,” DePasquale said.

Statutory language in the 2004 amendment limits pension forfeiture to PSERS members who commit crimes against students.

The narrow scope of the law not only fails to provide consequences when the victim is someone other than a student, but it also fails to ensure that the forfeiture provision covers anyone who performs any services directly benefiting a public school and receives pension benefits, including retired school employees who continue to directly perform services for a district.

“The restrictive language of the Public Employee Forfeiture Act is outrageous,” DePasquale said. “It is unconscionable to think that a person could commit a sex crime at work and still receive a pension if the victim is not a student. The law needs to be broadened now.”

DePasquale’s review of PSERS’ compliance with the Public Employee Forfeiture Act also revealed the need for procedural improvements with regard to both PSERS’ pension forfeiture case discovery process as well as with PSERS’ process to stop annuity payments upon conviction.

Auditors found that between July 2013 and October 2016, PSERS properly determined that 44 convicted members should forfeit their pension. In two of the 10 forfeiture cases reviewed, PSERS failed to recoup a total of $1,709.12 in pension payments made after a conviction.

PSERS needs to do more to identify potential pension forfeiture cases. The audit recommends PSERS use its statutory authority to require public schools to report employees convicted of pension forfeiture-related crimes.

“PSERS literally has the legislative authority to require public schools to report when an employee is convicted of a pension forfeiture-related crime,” DePasquale said. “That they choose not to use it is unbelievable.

“Not only is it the law, but given the current underfunded state of the retirement system, PSERS should make every attempt to recuperate pension payments made after conviction of a forfeiture-related crime.”

Improve Education and Attendance

“It is absolutely critical that PSERS’ trustees have a comprehensive understanding of the full range of their fiduciary duties and responsibilities as trustees who are entrusted with the management of $49.2 billion in investments for the pension fund,” DePasquale said.

Despite PSERS being the 20th largest state-sponsored defined benefit pension fund with 505,000 members, there is no statutory requirement in the Public School Employees’ Retirement Code for the 15-member board of trustees to receive a certain amount of annual investment training and there is no requirement for trustees to attend any training sessions that are offered throughout the year.

“PSERS’ trustees have a fiduciary duty to make decisions on investing nearly $50 billion,” DePasquale said. “Just because the current trustees attend educational sessions that PSERS offers each year doesn’t mean that all future trustees will, which is why continuing education and attendance requirements need to be included in the retirement code.”

The audit also recommends that PSERS establish and implement provisions within the board’s education policy to require each trustee to complete a self-evaluation of their financial educational needs at least annually to assist in identifying topics for training.

Auditors found overall attendance at board meetings to be above 90 percent, however, PSERS has no attendance policy and there is inconsistent attendance between certain board members and their multiple designees.

“I understand and agree with the use of a designee for certain board members,” DePasquale said. “However, constantly interchanging the presence of the board member and up to two designees at meetings and education sessions may negatively impact the board’s decision-making process. Writing attendance policies into the retirment code will help ensure PSERS continues to have the broad perspectives of qualified individuals serving on the board.”

Overall, PSERS agreed or partially agreed with most findings and is committed to implementing many of the suggested recommendations. PSERS’ response to the audit report is included in its entirety starting on page 105 of the audit report.

The PSERS audit report is available online at: http://www.PaAuditor.gov.

Auditor General says Public School Employee Retirement System must work harder to reduce fees, improve operations

HARRISBURG, PA — Auditor General Eugene DePasquale said today his performance audit of the Public School Employees’ Retirement System (PSERS) found the ne...