YORK COUNTY, Pa. — Dan Baker feels like he is being squeezed out of every small business loan process. The owner of Bridgewater Golf Club in York County says his loan applications never seem to make the cut before the state and federal programs run out of money.

“I have received zero help financially. None. Nothing,” stated Baker.

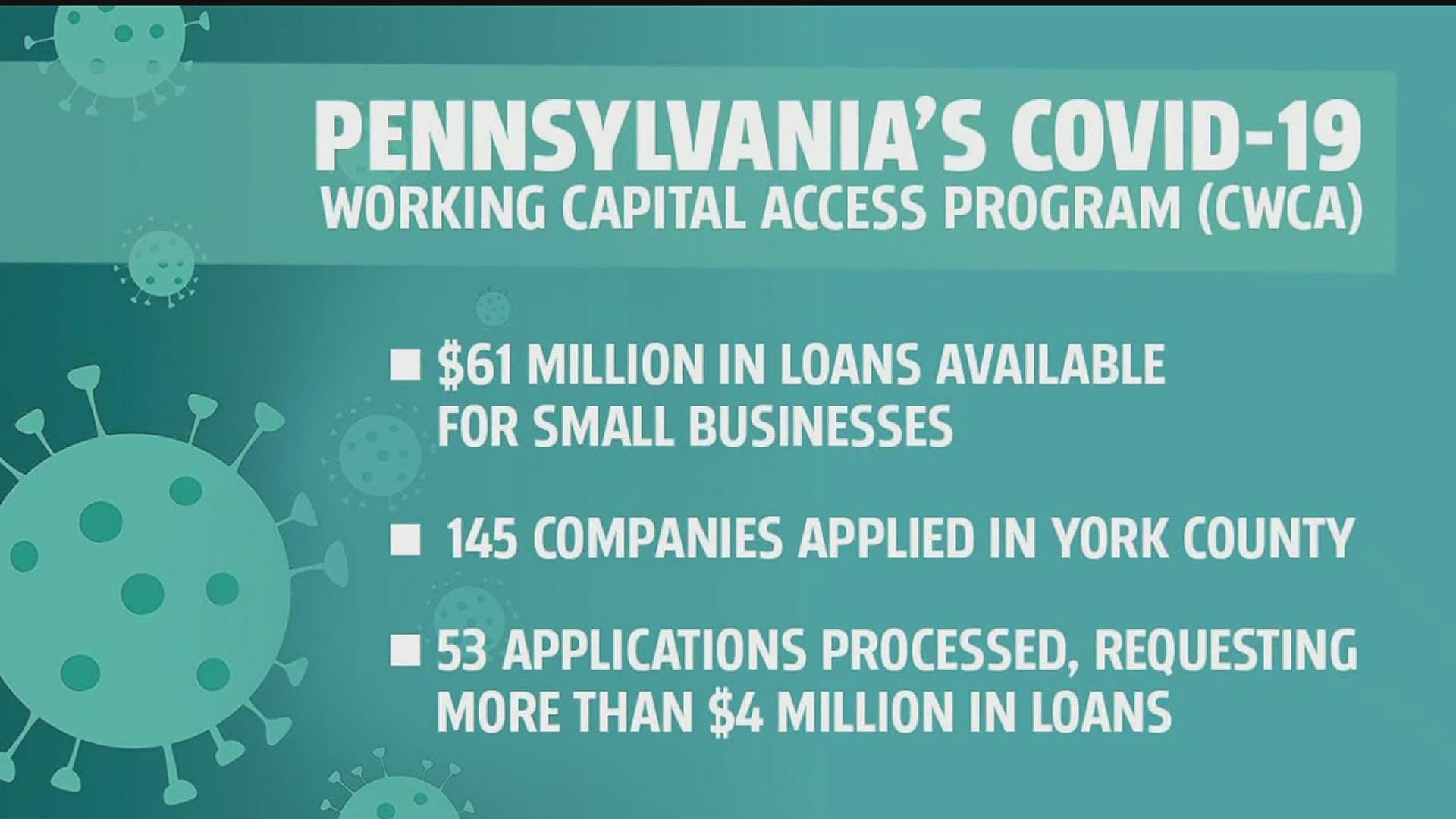

The simple answer: there’s a big money problem. On March 25, Governor Tom Wolf announced funding in a new state program called COVID-19 Working Capital Access (CWCA). The program made $61 million in loans available to small businesses, but it ran out of money in just seven days.

“I just want an answer," declared Baker. "How did this happen? Because this is killing me."

Banks and county agencies have been working in overdrive to process as many loans as possible before time runs out. Kevin Schreiber, president and CEO of the York County Economic Alliance (YCEA), said it felt like the sky was falling around them.

“We had to get credit reports, cash flow analyses, all that stuff and then get it off to the state," explained Schreiber. "It’s been a herculean effort working around the clock, through the weekend and we were inundated with applications. We were instructed by the state to take them first come, first serve.”

RELATED: COVID-19 working capital access program provides relief to hundreds of additional businesses

Schreiber said YCEA staff could only process 53 out of 145 applications before the CWCA program ran out of money. Those 53 loan applications requested more than $4 million. So far, 30 companies in York County have been approved by the state for a CWCA loan amounting to $2.3 million. The loans range from $8,700 to the maximum amount of $100,000.

Baker thought the state would have rationed the money so that every small business would get some sort of funding through the CWCA program.

“Just take the average. That’s around $78,000 each! That really kind of set me off,” exclaimed Baker. “I could have used $5,000!”

Though Bridgewater Golf Club is now back open for business, Baker is among many other small business owners who believe a federal loan is their only chance of survival. Baker was finally approved for a loan under the Paycheck Protection Program (PPP). However, he still has not received those funds.

“If this money from the Small Business Administration (SBA) wasn’t coming in a few days, I think in two weeks I’d have to shut the doors and claim bankruptcy,” said Baker.