HARRISBURG, Pa. — Scammers are trying to take advantage of the fear and anxiety surrounding the coronavirus pandemic by phishing for personal data. Banks are cautioning their customers to be vigilant as the global crisis provides fuel for cyber criminals.

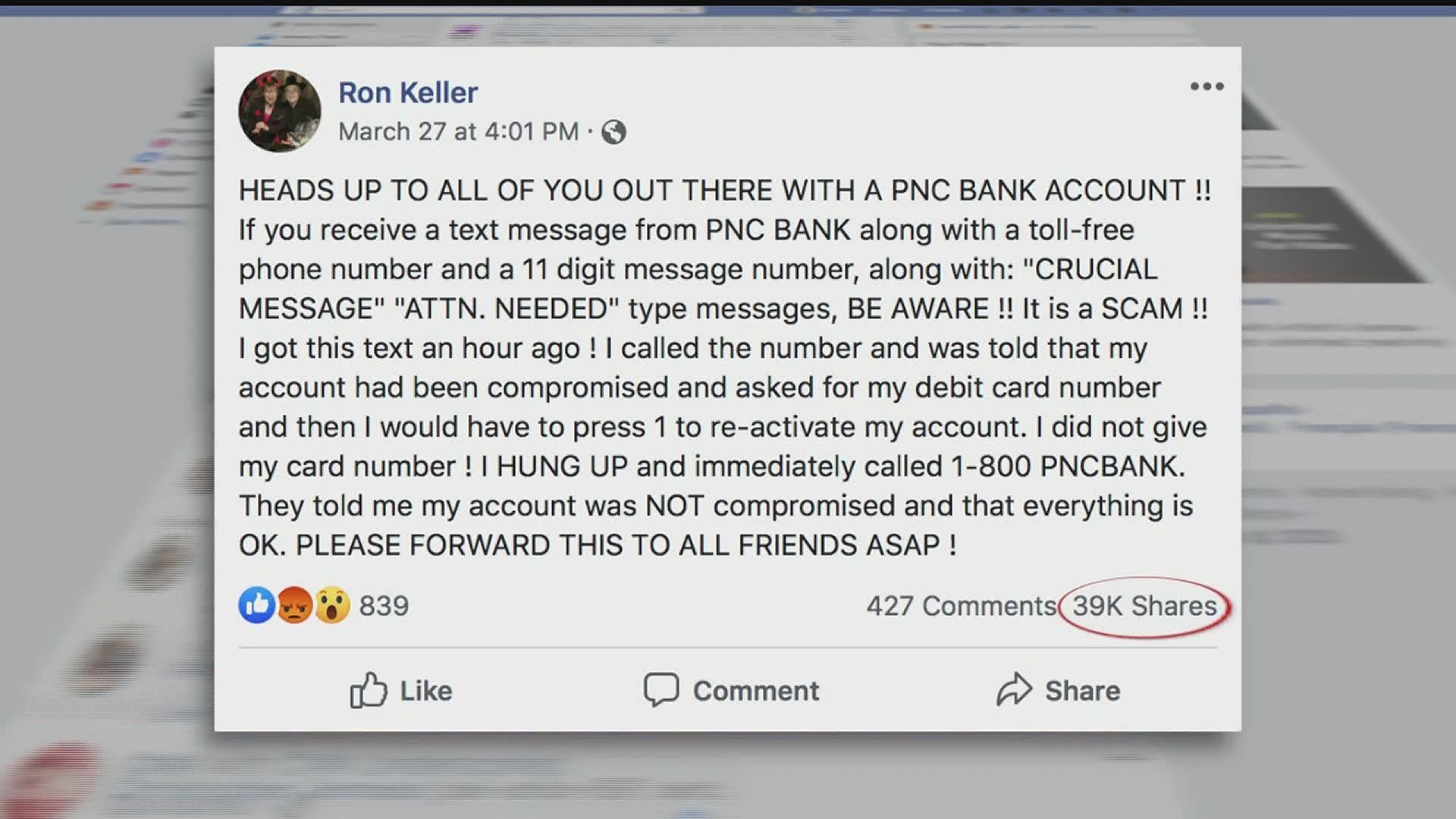

PNC Bank said there are many different scams currently at play. Dozens of people have recently received a suspicious text message that appears to be from PNC customer service. The message states a customer’s account is locked and urges them to call a fake number. A PNC Bank representative confirmed the text is a scam. The bank will never ask a customer for personal information via text message.

This is one example of many ongoing scams tied to the threat of COVID-19.

"The reality is that anybody can become a victim," said Tim Arthun, Deputy Secretary of Financial Services at the Pennsylvania Department of Banking and Securities (DoBS).

The department is tracking a number of scams as fraudsters try to take advantage of unsuspecting people in the face of a global pandemic.

Here are some examples of how fraudsters are using the global crisis to phish:

- Impersonating a representative of a bank or other financial institution providing or requesting information about your account.

- Seeking donations for charitable causes related to the virus.

- Impersonating a legitimate medical or health organization selling products that claim to prevent, mitigate, treat, diagnose or cure coronavirus.

- Posing as an in-demand medical supply company offering to sell hard-to-find medical supplies to protect against the virus.

- Taking advantage of the recent increase in work-at-home arrangements by impersonating legitimate business correspondence.

- Posing as a government organization claiming to provide information about the coronavirus, such as heat maps or infographics.

"A government agency, or your financial institution, is never going to call you uninitiated and ask you to verify [information], whether it be your social security number or account number," explained Arthun. "That's usually a red flag of a scam."

Other red flags include messages that make urgent demands, contains grammatical errors and misspellings, and requests that charitable donations are sent by gift cards or wiring money.

During a digital town hall on Instagram, Pennsylvania Attorney General Josh Shapiro reminded consumers that any unexpected message from their banks should be reported.

“Don’t answer those calls that you weren’t expecting, where people are suggesting they can somehow help,” urged Attorney General Shapiro. "Those are scams. Those are people trying to take advantage of you.”

The best line of defense against scammers is to hang up and delete the email or text message, according to DoBS. If you think you may have fallen victim to a scam or want to make a report, you can file a complaint with the Federal Trade Commission or the Attorney General’s Office.