LANCASTER, Pa. — Applications for President Biden’s student loan relief program are expected to open this month, potentially freeing millions of Americans from up to $20,000 of debt per eligible borrower.

“We’re told a lot of this will be automatic, almost like the stimulus checks were," said Eric Kopp, associate director of financial aid at Franklin & Marshall College.

Yet for current and former students, as well as college financial aid offices, a lot of questions remain.

“The application is not there, you only need the application supposedly if it doesn’t automatically go into effect, so I think there is a little bit of confusion that will hopefully be cleared up before this month is over," explained Kopp.

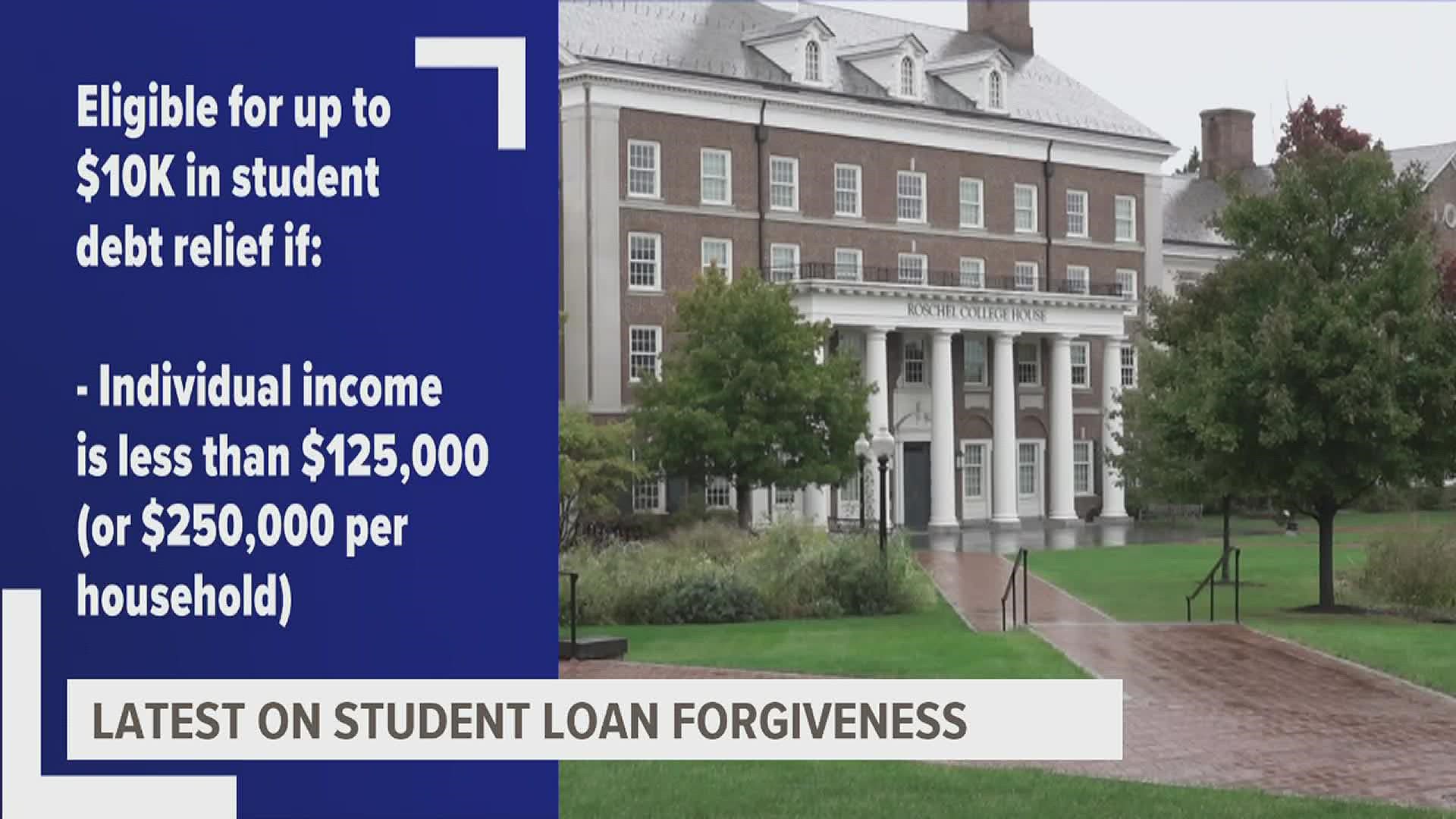

The Biden Administration announced in August borrowers of federal loans are eligible for up to $10,000 in debt cancellation, as long as they fall into specific income requirements.

To be eligible, your individual income must be less than $125,000 a year, or $250,000 per household.

Pell Grant recipients are eligible for an additional $10,000 in relief.

"They’re trying to help those whose parents didn’t have a ton of money to help them through the education process," said Mary Jo Terry, managing partner at Yrefy.

Late last week, the government quietly changed eligibility requirements, amid legal challenges from GOP-led states.

"There are hundreds of thousands of borrowers that may not quality that were under the impression they were going to, so it’s news to them as well," said Kopp.

The federal student aid website now states as of September 29, borrowers with loans not held by the Education Department cannot get one-time debt relief by consolidating these loans into Direct Loans.

"My understanding is that it’s a portion of some federal loan borrowers that had federal Family Education loans may not be eligible as well as federal Perkins loan borrowers," explained Kopp.

Experts say the best thing to do is to contact your loan servicer with questions, and when the application opens, fill it out.

“If you think you’re eligible, or you’re not sure, fill it out," said Terry. "You have nothing to lose.”

The Biden Administration has said the application for debt relief will open in early October, but an exact date has yet to be announced.

As for those borrowers recently scratched from debt relief eligibility, the Education Department says it is discussing with private lenders if there are alternative ways to provide forgiveness.

Download the FOX43 app here.