HARRISBURG, Pa. — There are more than 118,000 low-income Pennsylvanians who may be missing out on state tax refunds of $100 or more, the state Department of Revenue announced Tuesday.

These refunds totaling an estimated $30.2 million are available through the commonwealth’s Tax Forgiveness program, the department said in a press release.

The Department of Revenue said it has been mailing letters to Pennsylvanians who may qualify for this relief to encourage them to take action to claim their refunds.

Often the people who have missed out on claiming these refunds simply need to file a Pennsylvania Personal Income Tax Return (PA-40) and the appropriate schedule to secure the money they are owed, the department said.

“We want the public to know that there are refunds waiting for thousands of Pennsylvanians, including many low-income families and retirees who could greatly benefit from this money,” Revenue Secretary Dan Hassell said. “If you have a neighbor, friend or family member whom you think may be eligible, please encourage them to check their eligibility and file a tax return with our department.”

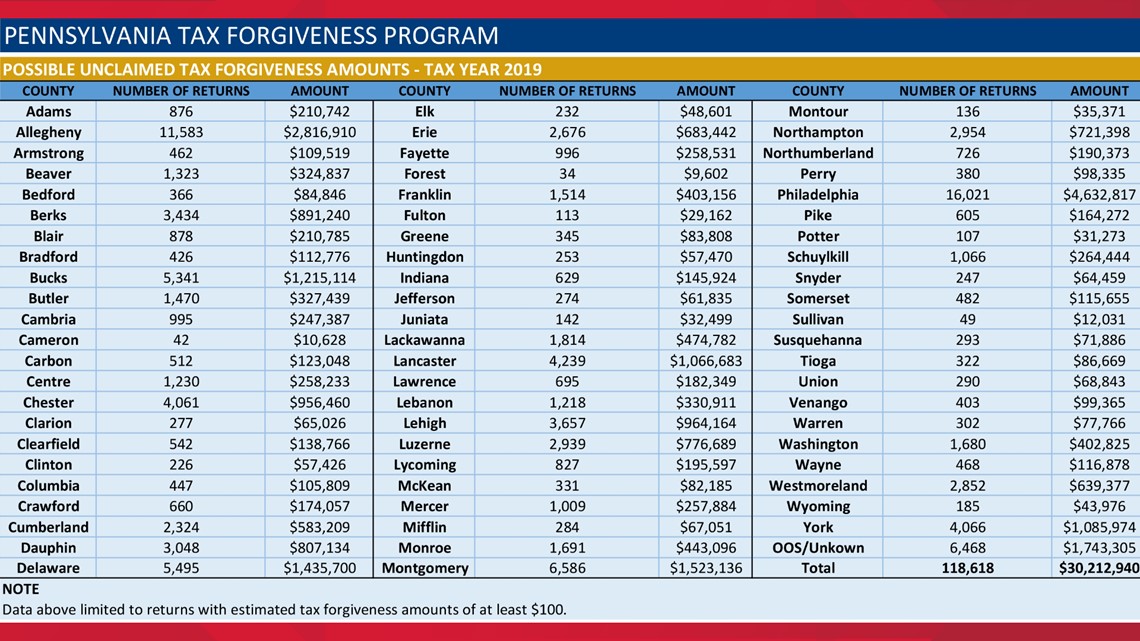

The Department of Revenue has prepared county-by-county estimates of refunds totaling $100 or more that are available through the Tax Forgiveness program.

How to File a PA-40 and Claim Tax Forgiveness

One easy way to file your Pennsylvania Personal Income Tax Return (PA-40) and the required additional form, Schedule SP, is by using myPATH, the Department of Revenue’s free, online tax filing system, the department said.

Visit mypath.pa.gov and look at the links under the “Individuals” section on the homepage. You can click on either “File a Personal Income Tax Return for 2021,” “File a PA Personal Income Tax Return for 2020,” or “File a PA Personal Income Tax Return for 2019.” This will allow the taxpayer to file a return for the appropriate year and claim a refund through Tax Forgiveness.

There is also an option to file the 2021 Personal Income Tax Return in Spanish by clicking on the “Presentar una declaracion deimpuestos sobre la renta personal de PA para 2021” option under the “Individuals” section.

Taxpayers do not need to create a username or password to file the PA-40 and Schedule SP. Prior to filing your return, you will need your wage and tax information. The system will walk you through a series of steps to file your return and determine your eligibility for Tax Forgiveness.

Other free electronic filing options are available to file state and federal returns using software from a reputable vendor. More vendor information is available on the Department of Revenue's website.

Background on Tax Forgiveness

Through Tax Forgiveness, eligible working families who paid income tax throughout the year may be refunded some or all of that tax paid. Retired persons and low-income individuals who did not have PA income tax withheld from earnings may have PA income tax liabilities forgiven, according to the department.

About one in five households qualify for Tax Forgiveness and it is a benefit commonly received by retirees and low-income workers, the department said. A family of four (couple with two children) can earn up to $34,250 and qualify for Tax Forgiveness.

Meanwhile, a single-parent, two-child family with income of up to $27,750 can also qualify for Tax Forgiveness.

Visit the Tax Forgiveness page on the Department of Revenue’s website for further eligibility information, including eligibility income tables.

Keep in mind that people who are claimed as a dependent of another taxpayer are not eligible to receive Tax Forgiveness. There are additional instructions available in the Tax Forgiveness section of the Department of Revenue’s PA Personal Income Tax Guide.

Taxpayer Service and Assistance

Those with questions on Tax Forgiveness can finds answers through the department's Online Customer Service Center. The Online Customer Service Center allows taxpayers to securely submit a question to the department through a process that is similar to sending an email.

Taxpayers may also visit www.revenue.pa.gov/offices to view contact information for the Department of Revenue’s district offices. You can contact the district office closest to you to schedule an appointment for in-person assistance. There is also phone and email information available on this web page to contact the district office that is closest to you.

For more information on the Tax Forgiveness program, visit revenue.pa.gov/taxforgiveness. For other free tax forms and instructions, please visit www.revenue.pa.gov.